The Importance of Reconciling Transactions for Balanced Accounting

Reconciling transactions is a critical step in maintaining accurate financial records. For any business, ensuring that the financial statements reflect reality is essential for decision-making, tax preparation, and compliance. Reconciliation involves comparing the transactions recorded in your accounting system with external documents, like bank statements, to ensure all financial activities are accurately captured.

Why Reconciliation Matters

1. Error Detection: Manual or automated errors can occur during the recording of transactions. Regular reconciliation helps catch and correct these discrepancies, ensuring your records match your actual cash flow.

2. Fraud Prevention: Reconciling accounts allows you to detect unauthorized transactions, protecting your business from potential fraud.

3. Improved Cash Flow Management: Keeping your accounts up to date ensures that you know exactly how much money is available, helping you make informed decisions on expenses, investments, and savings.

4. Accurate Financial Reporting: When your books are reconciled, your financial statements will reflect a true and complete view of your business’s financial position, ensuring compliance with tax authorities and other regulatory requirements.

How to Reconcile Transactions Effectively

• Regular Reviews: Set a consistent schedule, whether weekly or monthly, to ensure your books are regularly checked against external sources.

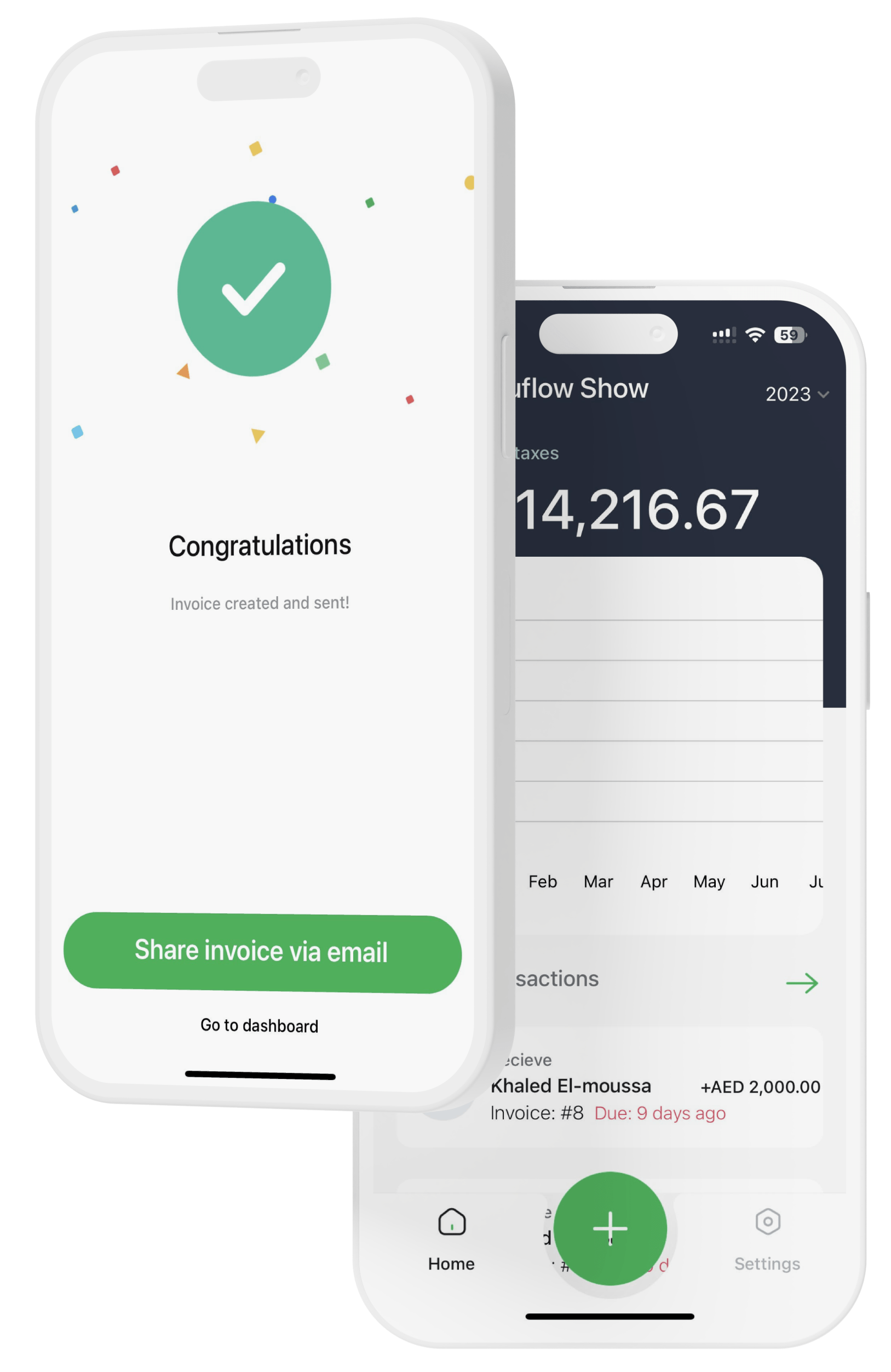

• Automate Where Possible: Tools like Fuluflow make reconciliation faster and more accurate by pulling data directly from your bank.

• Match Transactions: Ensure each transaction in your accounting system matches those on your bank statement. Look out for any discrepancies or missing entries.

How to Export Bank Statements for Reconciliation

Every bank has its own process, but the following guide outlines the general steps for exporting your bank statements:

"Fuluflow has been a game-changer for my small tech business. It's user-friendly and tailored to the UAE market, making VAT compliance a breeze"

"As a bakery owner, I needed a reliable accounting solution that understands the intricacies of the UAE's tax laws."

"Fuluflow has transformed the way we manage our tour company's finances. With its robust features and UAE-specific support, we can track expenses, manage invoices, and stay compliant effortlessly. It's a must-have tool for any small business in the UAE!"

"Fuluflow has simplified our accounting processes tremendously. Its real-time reporting and intuitive interface have given us better financial insights, helping us make informed decisions. We are grateful for this exceptional accounting software!"

"Fuluflow has been a lifesaver for our trading business. It's designed with the UAE market in mind, making tax calculations and reporting a breeze. The support team is responsive, ensuring we are always on top of our financial game. Thank you, Fuluflow!"