5 Proven Strategies to Avoid FTA Fines When Running Your Company in the UAE

Are you a business owner operating in the United Arab Emirates (UAE)? If so, you're likely familiar with the stringent regulations set forth by the Federal Tax Authority (FTA). While these regulations are designed to ensure compliance and fairness in the business environment, navigating them can sometimes be a daunting task, especially when it comes to avoiding fines and penalties.

FTA fines can be hefty and detrimental to your company's financial health. However, with the right strategies and practices in place, you can significantly minimize the risk of incurring fines and maintain a clean record of compliance.

Here are five proven strategies to help you avoid fines from the FTA when running your company in the UAE:

- Stay Updated with Tax Laws and Regulations: The tax landscape is constantly evolving, with new laws and regulations being introduced regularly. To stay ahead of the curve and ensure compliance, make it a priority to stay updated with the latest tax laws and regulations issued by the FTA. This includes understanding your tax obligations, filing deadlines, and any changes in tax rates or procedures that may affect your business.

- Maintain Accurate and Timely Records: Accurate record-keeping is essential for tax compliance. Keep detailed records of all financial transactions, including sales, purchases, expenses, and tax payments. Make sure your records are organized and up-to-date to avoid any discrepancies or errors that could lead to fines from the FTA. Additionally, ensure timely submission of tax returns and other required documents to avoid penalties for late filing.

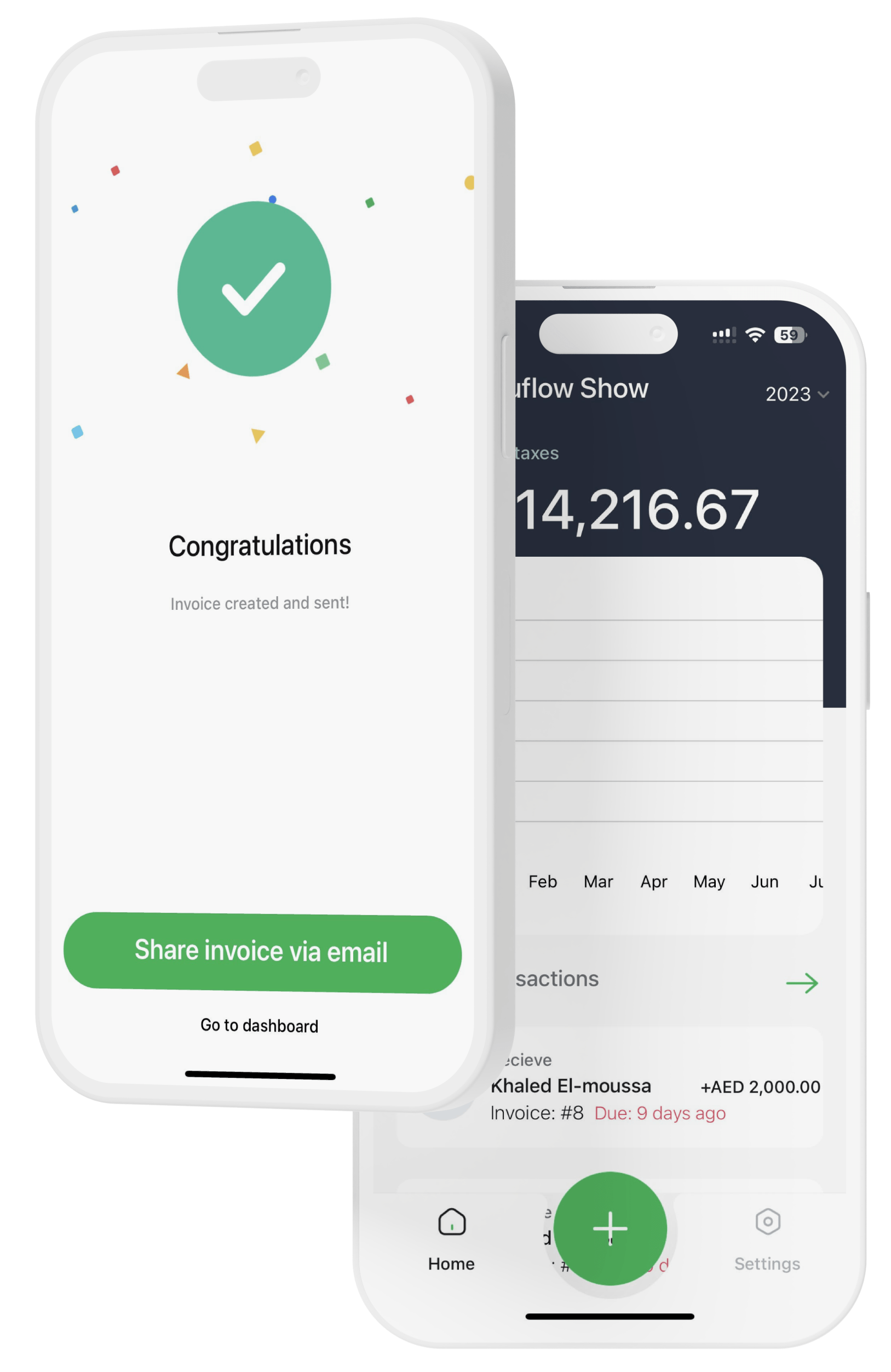

- Implement Robust Accounting Systems: Investing in robust accounting systems and software can streamline your financial processes and help ensure accuracy in your tax reporting. These systems can automate many tasks, such as invoicing, expense tracking, and tax calculations, reducing the likelihood of errors and discrepancies. Regularly reconcile your accounts and conduct internal audits to identify and rectify any issues proactively.

- Seek Professional Advice: Tax laws and regulations can be complex, especially for businesses operating in multiple jurisdictions or engaging in specialized activities. Seeking professional advice from tax experts or consultants can provide invaluable guidance and support in navigating the tax landscape and ensuring compliance with FTA regulations. Experienced professionals can help you identify potential risks, optimize your tax structure, and implement best practices to avoid fines and penalties.

- Respond Promptly to FTA Communications: In the event of an inquiry or audit by the FTA, it's essential to respond promptly and cooperatively. Ignoring FTA communications or failing to provide requested information in a timely manner can escalate the situation and result in additional fines and penalties. Maintain open communication channels with the FTA and address any inquiries or concerns promptly and accurately to demonstrate your commitment to compliance.

In conclusion, avoiding fines from the FTA requires a proactive approach to tax compliance and adherence to best practices. By staying updated with tax laws and regulations, maintaining accurate records, implementing robust accounting systems, seeking professional advice when needed, and responding promptly to FTA communications, you can minimize the risk of fines and penalties and ensure the continued success of your business in the UAE.

"Fuluflow has been a game-changer for my small tech business. It's user-friendly and tailored to the UAE market, making VAT compliance a breeze"

"As a bakery owner, I needed a reliable accounting solution that understands the intricacies of the UAE's tax laws."

"Fuluflow has transformed the way we manage our tour company's finances. With its robust features and UAE-specific support, we can track expenses, manage invoices, and stay compliant effortlessly. It's a must-have tool for any small business in the UAE!"

"Fuluflow has simplified our accounting processes tremendously. Its real-time reporting and intuitive interface have given us better financial insights, helping us make informed decisions. We are grateful for this exceptional accounting software!"

"Fuluflow has been a lifesaver for our trading business. It's designed with the UAE market in mind, making tax calculations and reporting a breeze. The support team is responsive, ensuring we are always on top of our financial game. Thank you, Fuluflow!"